Acclaimed High-Stakes

Orange County Divorce Attorneys

Serving High-Asset Divorce Clients In Orange County And Southern California From Our Newport Beach Office

18 Five-Star Ratings on

AVVO.com

AV Preeminent® Rating with Martindale-Hubbell® – Highest Possible Rating! From 2021 to 2023.

Rated on SuperLawyers.com

from 2020 to 2023

Why Nelson Kirkman is the Right Choice

High-asset divorces require world-class legal experts. If your divorce involves the disposition of complex property and high-value business interests, then you need our unique knowledge and legal expertise. Our partners are board-certified in family law and can help you navigate even the most challenging division of property issues. We recognize the need to arrive at a favorable settlement quickly so you can get on with your life, and your business.

Practice Areas

High Asset Divorce

Divorce

Spousal Support/ Alimony

Property And Asset Division

Prenuptial And

Postnuptial Agreements

Child Custody And Visitation

Child Support

Business And Divorce

We Make Divorce A Simple Process

First we talk. Choosing a divorce attorney is a lot like dating. We begin by getting to know each other. Establishing expectations sets the stage for a successful relationship. Then we can start negotiating with your spouse and their attorney. No one benefits from a long, messy divorce. That’s why we recommend opening with a first, best offer. This can save time, money and heartache.

If a settlement can’t be reached, we will argue your case before a judge. We will be aggressive and fair. Our goal is to make sure you get all to which you are entitled.

Client Testimonials

A Team Of Highly Rated Attorneys

Led By Board-Certified Specialists In Family Law

Our founding partners, Paul J. Nelson and Graham D. Kirkman, are board-certified in family law by the state of California. They have a stellar track record and are known for resolving complicated family law matters with a minimum of strife and animosity between parties. We are respected and well-known for our integrity within the legal community. This allows us to avoid unnecessary gamesmanship in negotiations and resolve legal issues effectively and efficiently. However, we approach all cases as if they’re going to trial, so we are always extremely prepared.

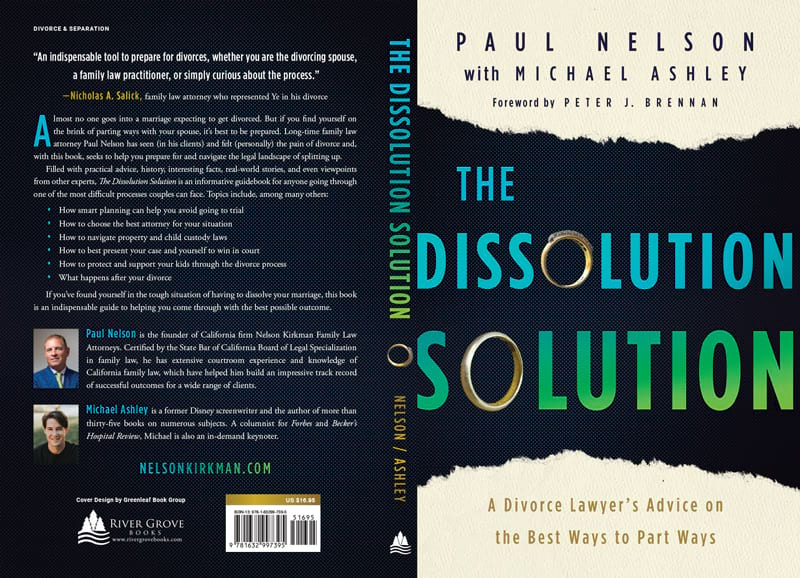

The Dissolution Solution by Paul J. Nelson

Founding partner Paul J. Nelson has written a book on how to avoid pitfalls in a high-stakes divorce. From prenuptial agreements to “financial infidelity” and dividing marital property, Paul lays out how to protect your assets and plan for the future while navigating the divorce process.

Even If Your Marriage Is Bad, Your Divorce Doesn’t Have To Be.

At Nelson Kirkman, we aren’t just attorneys focused on the legal side of things, we also serve as unofficial counselors for our clients. We truly care about helping people through the hardest times of their lives. Our legal team has over 50 years of combined experience serving family law clients. We recognize that family law touches your life in myriad ways. It isn’t just your home and your assets, it is also your children, your livelihood and your general well-being. That is not something we take lightly.

If you need legal guidance on issues affecting your family or finances before, during or after marriage, we can help. To schedule a consultation, call 949-430-6952 or fill out our online contact form.

Meet The Partners

As Seen In

For unparalleled service in high-asset divorce and other family law matters,

contact Nelson Kirkman.